It’s no secret…

Electronic document signing (aka eSigning) has been around for over a decade.

And it’s easy to see why this appeals to so many people. Because instead of signing stacks of documents by hand, you can digitize your paperwork, use a cloud-based process, and go paperless.

Sounds simple, right? But oddly enough, the U.S. reverse mortgage lending industry has been slow to adopt. And we mean, unrealistically, frustratingly slow. Because even now, in 2022, most states still don’t allow eSigning technology for loan closings and applications.

So before you start the loan doc process or schedule your close, here’s a quick look at the pros and cons of eSigning in the reverse mortgage lending industry.

Pros of eSigning

- Borrowers and lenders are more confident using solutions that capture real signatures

- It ensures readability and consistency: this is great because most eSignature solutions automatically timestamp any information entered into a contract. So not only does this make the document easier to read (some of us have bad handwriting), it builds more credibility and trust.

- Immediate transfer of executed closing packages translates to faster reviews for funding: this is one of the biggest benefits to eSignatures – a streamlined process gets everyone what they want faster with less stress.

- A seamless closing process: eSigning builds familiarity with (and confidence in) the eSigning process. This results in a faster closing process and overall acceptance of the eSigning practice in the mortgage lending industry.

Cons of eSigning

- Believe it or not… not all states allow for the use of e-signing solutions and still require “wet ink.”

- eSigning is a technology expense to the signing agent: signing agents want to mitigate expenses as much as possible. And while eSigning can save time, the cost can be a problem based on the volume of signings performed.

- Some eSign solutions require the signing agent to ‘flag’ areas of the document for signatures, initials and dates. Manually flagging documents may seem like a simple task, but compound that across dozens, if not hundreds, of signings per month and now you have a real problem. Not every eSigning solution does this but it’s an important factor to consider. Yeah, the flags are helpful for the borrower but end up eating a lot of the signing agent’s time.

So… Now What?

Whether you use an eSigning solution or not may come down to where you are in the United States.

As the world moves to more remote, digital solutions across a variety of industries, we expect to see a strong push towards eSigning industry wide.

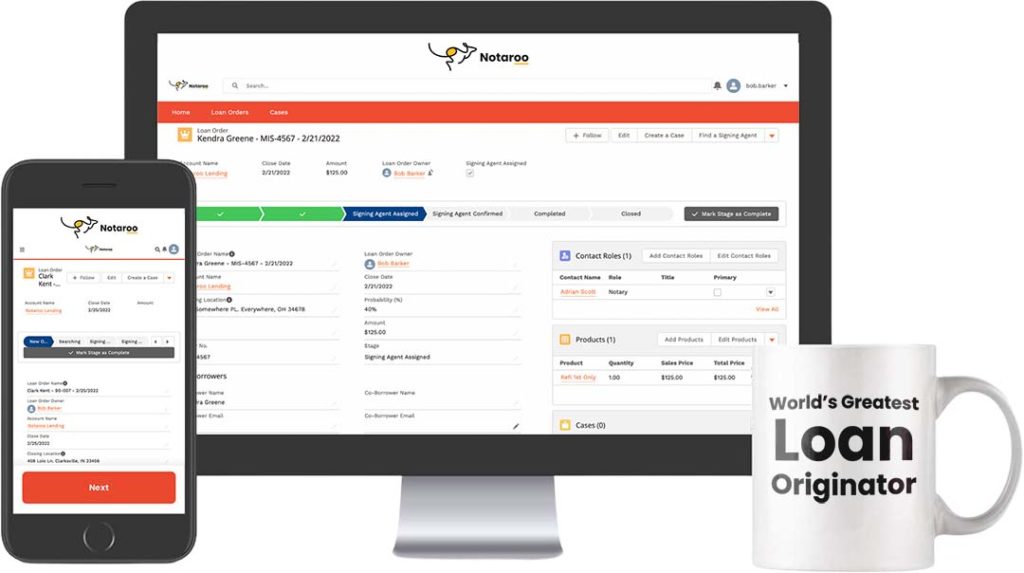

But in the meantime… Meet Notaroo.

We provide a completely managed, error-free, fully-integrated loan processing experience with a high level of security and no extra costs. And although reverse mortgages usually require “wet ink”, we can still accommodate eSignings nationwide.

So you can say goodbye to multiple logins, unnecessary back and forth, and stress-inducing phone calls where you have to tell yet another person where to find the home insurance policy and last three months of bank statements.

You can get a free demo here (with no strings attached).

Because loan processing platforms shouldn’t create more problems than they solve. And in 2022, it’s more important than ever to have a streamlined, transparent closing process from beginning to end.

That’s why we built Notaroo – to bring calm to the chaos of closings, for every person involved, at each step of the process.

Click here to get a demo (we’ll even throw in 10 FREE signings when you do).

To faster closings,

The Notaroo Team